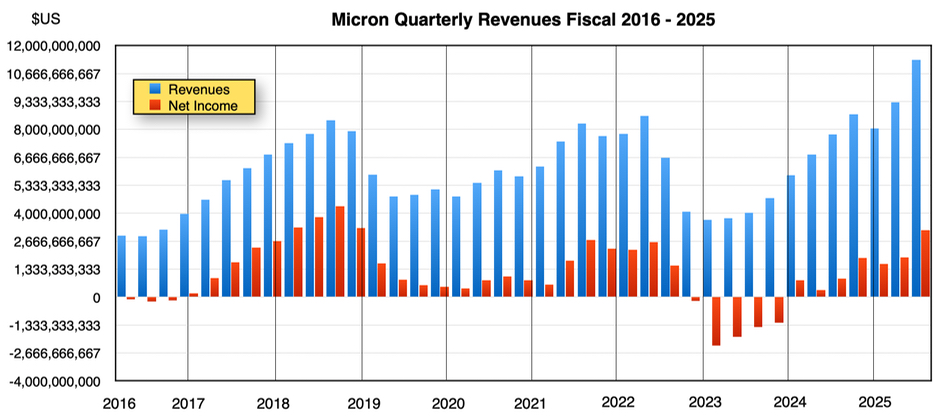

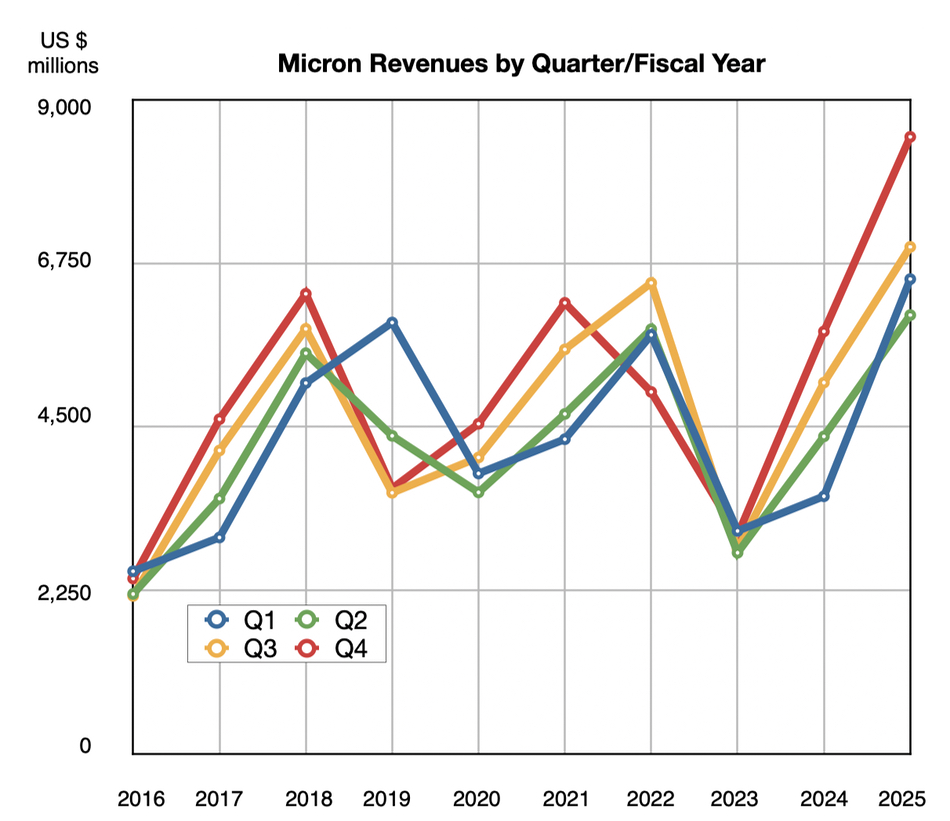

Micron revenues passed $11 billion in its final FY 2025 quarter as hyperscalers bought more memory than ever before.

Revenues in the quarter, ended August 28, 2025, were a record, at $11.32 billion, an all-time high, beating its $11 billion high-end outlook, and 46 percent higher than the year-ago $7.75 billion, with a GAAP profit of $320 million, up 261 percent year-over-year. Full FY 2025 revenues were $37.38 billion, 48.9 percent higher than a year ago, with a profit increase to $8.54 billion.

Chairman, president, and CEO Sanjay Mehrotra stated: “Micron closed out a record-breaking fiscal year with exceptional Q4 performance, underscoring our leadership in technology, products, and operational execution. In fiscal 2025, we achieved all-time highs across our datacenter business and are entering fiscal 2026 with strong momentum and our most competitive portfolio to date.” He also mentioned pricing execution.

Financial summary

- Gross margin: 44.7 percent vs 35.3 percent a year ago

- Operating cash flow: $5.73 billion vs $3.41 billion a year ago

- Free cash flow: $803 million vs -$758 million last year

- Cash, marketable investments, and restricted cash: $11.94 billion vs $9.2 billion last year

- Diluted EPS: $2.83 vs $0.79 a year ago

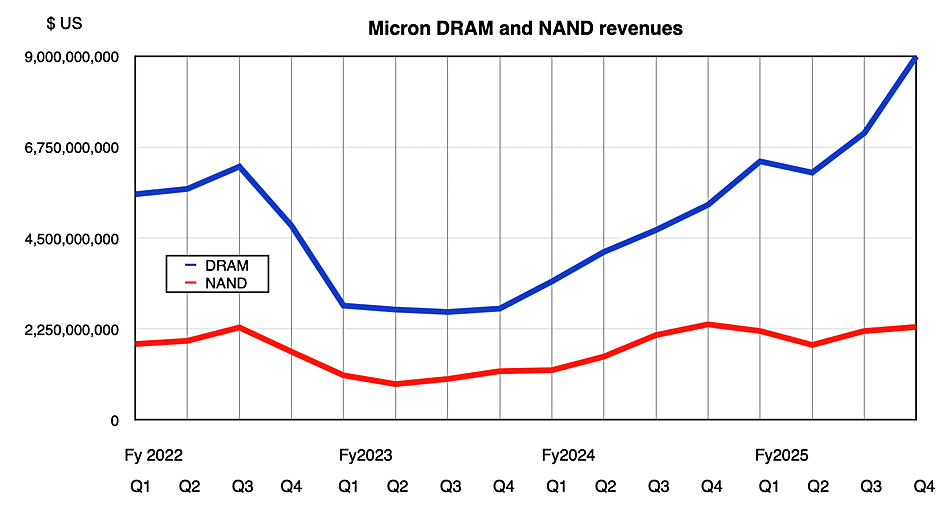

DRAM revenues increased by 69 percent year-over-year to $9 billion from $5.3 billion, with HBM reaching a record, but NAND revenues declined 5.0 percent to $2.3 billion. NAND bit shipments went down but, as prices increased, revenues didn’t decline as much as they would otherwise have done.

Basically, DRAM is 80 percent of Micron’s revenues and rising, while NAND is 20 percent and flat.

Mehrotra was bullish on Micron’s DRAM technology, saying: ”Our 1γ DRAM node reached mature yields in record time, 50 percent faster than in the prior generation. We are the first in the industry to ship 1γ DRAM and will leverage 1γ across our entire DRAM portfolio to maximize the benefits of this leadership technology. We achieved first revenue from a major hyperscale customer on our 1γ products for server DRAM in the quarter.”

Micron aims to boost production, installing its first EUV tool in its Japan fab to enable 1γ capability, which will complement its existing 1γ supply from fabs in Taiwan. US federal funds will help too. Micron received a CHIPS grant disbursement for a new high-volume manufacturing fab in Idaho (ID1), with the first wafer output expected to begin in the second half of calendar 2027. The firm began design work on a second Idaho manufacturing fab (ID2), which will provide additional capacity beyond 2028.

Micron’s HBM manufacturing capacity is increasing too. Mehrotra said:”Our continued HBM assembly and test investments position us well to meet growing HBM capacity requirements in calendar 2026. We are making good progress on our Singapore HBM assembly and test facility construction, which is on track to contribute to our HBM supply capability beginning in calendar 2027.”

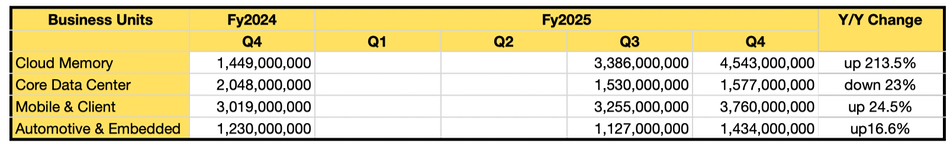

Micron has changed its business unit reporting structure. Up until last quarter its four BUs were Compute & Networking, Mobile, Storage and Embedded. These now change to Cloud Memory, Core Data Center, Mobile & Client, and Automotive & Embedded and we lose clarity on Micron’s storage revenues. CFO Mark Murphy said: ”The Cloud Memory Business Unit and Core Data Center Business Unit combined represent the totality of our datacenter business.”

The new business unit revenue results were:

Cloud memory sales have shot up year-over-year while the core datacenter sales revenue has gone down, which is unexpected. We continually hear that AI server demand is rising and that such servers need DRAM and flash, yet Micron’s numbers appear to contradict that view.

High-Bandwidth Memory

HBM revenue grew to nearly $2 billion, implying an annualized run rate of nearly $8 billion, driven by the ramp of its HBM3E products. Micron says: “We have pricing agreements with almost all customers for a vast majority of our HBM3E supply in calendar 2026. We are in active discussions with customers on the specifications and volumes for HBM4, and we expect to conclude agreements to sell out the remainder of our total HBM calendar 2026 supply in the coming months.”

It has recently shipped next-generation HBM4 samples and believes it “outperforms all competing HBM4 products, delivering industry-leading performance as well as best-in-class power efficiency.“ Micron is also working on HBM4E (Extended), partnering with TSMC for manufacturing the HBM4E base logic die for both standard and customized products. It sees HBM4E as a 2027 timeframe product.

Micron has six HBM customers and the HBM outlook is good: “Our HBM share is on track to grow again, and be in line with our overall DRAM share in this calendar Q3, delivering on our target that we have discussed for several quarters now.” Its DRAM market share is around 22.5 percent.

As the HBM market is expected to be worth $50-60 billion in 2026, Micron’s hoped-for 22.5 percent share would be $12.58 billion – say, $3.1 billion/quarter. Looking even further ahead, Micron had said that by 2030, it expected HBM’s total addressable market to reach $100 billion.

AI and outlook

Micron is using AI internally and says it’s “seen strong adoption and as much as a 30-40 percent productivity uplift in select GenAI use cases, such as code generation.” It’s “driven a 5x increase in wafer images analyzed in the past year and doubled the amount of useful data and telemetry collected and analyzed from our fab tools, all of which improve our yield performance.“

AI PCs and AI-capable smartphones will both need more DRAM. Mehrotra said: ”Overall, AI trends are strong, and this is across datacenter, across AI-enabled smartphones and AI-enabled PCs. This is what leads to strong demand in 2026, across 2026.” And supply will be tight, leading to higher prices.

Mehrotra told earnings call attendees: “We have strong momentum entering fiscal 2026 with a robust fiscal Q1 demand outlook led by datacenter and the most competitive position in our history. Over the coming years, we expect trillions of dollars to be invested in AI, and a significant portion will be spent on memory. As the only US-based manufacturer of memory, Micron is uniquely positioned to benefit from the AI opportunity ahead.”

Next quarter guidance is for revenues of $12.5 billion ± $300 million, a rise of an impressive 43.5 percent year-over-year at the midpoint. Datacenter sales should increase, with Micron saying “we now expect calendar 2025 total server units to grow approximately ten percent, up from our prior expectations of mid-single digits percentage growth,” with growth in both AI and traditional servers ramping up DRAM demand.

Bootnote

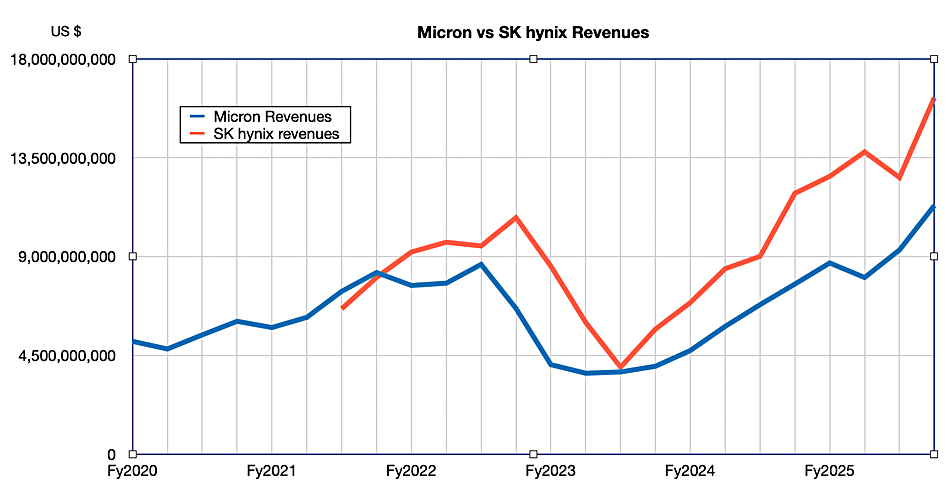

Although Micron is doing well in HBM, it is still lagging behind market leader SK hynix, as a revenue comparison history chart illustrates: