Dell is claiming the number one position in the all-flash array (AFA) market, citing IDC numbers. Yet, just last month, NetApp claimed it led the AFA market.

NetApp said in August, when reporting its first quarter fiscal 2026 results (ended July 25, 2025), that it “achieved the #1 market share position in all-flash storage for calendar Q1 2025, as reported by IDC.” CEO George Kurian said: “By helping customers modernize with cutting-edge and cyber resilient storage solutions, we have taken the lead position in the all-flash market.”

The IDC report was the Worldwide Quarterly Enterprise Storage Systems Tracker, June 2025.

Dell vice chairman and COO Jeff Clarke then put out an X post on 19 September, saying: “#1 in all-flash storage vendor revenue. Proof that innovation and execution win!” He linked it to a blog by Travis Vigil, Dell’s SVP for Product Management in its Infrastructure Solutions Group (ISG).

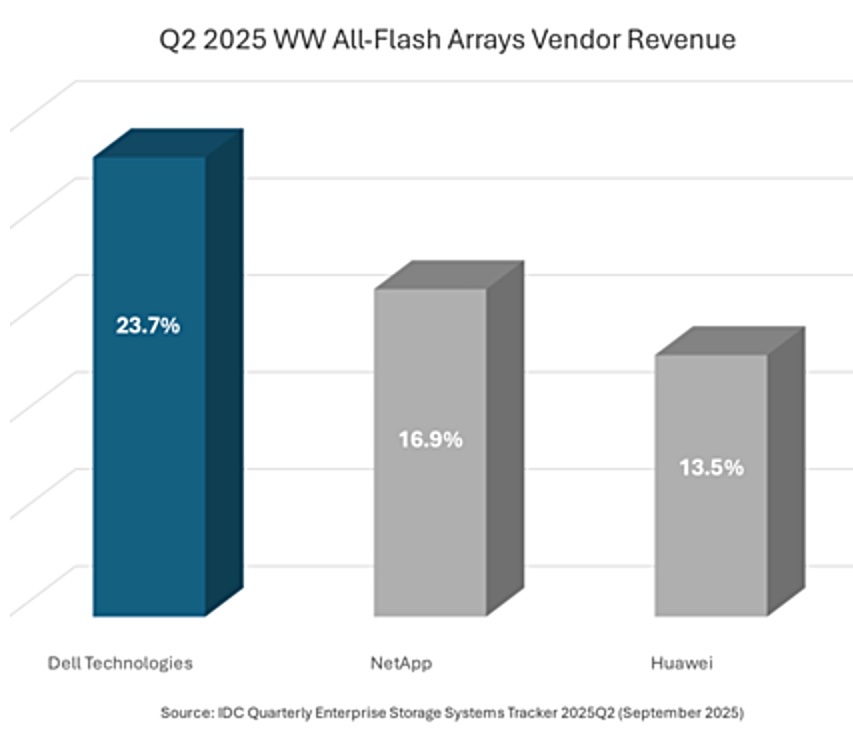

Vigil’s blog was headlined by this statement: ”Undisputed: Dell Technologies Ranked #1 in All-Flash Storage Vendor Revenue,” and followed by this one: “Dell Technologies is the leader in all-flash storage vendor revenue per IDC.” A chart illustrated the claims:

It refers to calendar Q2, 2025, and is backed up by IDC’s WW Quarterly Enterprise Storage Systems Tracker, 2025 Q2 historical release, September 11, 2025. That would be roughly equivalent to NetApp’s first fiscal 2026 quarter, ended July 25, 2025, when its AFA revenues were $893 million. If that represents 16.9 percent of total vendors’ AFA revenues in the quarter, then Dell’s 23.7 percent equals $1.25 billion and Huawei’s 13.5 percent equals $713.3 million.

This means that Dell regained the number 1 AFA market revenue share position in the second calendar quarter after losing it to NetApp in the first quarter. NetApp’s calendar first quarter is roughly equivalent to its fourth fiscal 2025 quarter, ended on April 25, when its AFA revenues were $1.03 billion.