Unified database startup SingleStore has been bought by private equity house Vector Capital Management instead of raising more cash or running an IPO.

SingleStore provides a combined transactional, analytical, and vector database that can run in memory, supports external storage, operates with low latency on-premises or in the public cloud, and has a growing AI focus. It has just announced strong second quarter fiscal 2026 results with ARR of over $123 million, growing 23 percent year-on-year. Total net new ARR grew 34 percent Y/Y. It has free cash flow for the last 12 months of negative ~$2 million, within touching distance of break even. At the end of the period, the company had more than $150 million in cash and zero debt, providing a robust balance sheet for continued growth both organic and inorganic.

Raj Verma, CEO of SingleStore, stated: “We are seeing clear evidence that our strategy and execution are working. Customers are scaling with us, retention is world-class and we’re operating with outstanding financial discipline. Our pipeline is deeper and healthier than ever, and I have tremendous confidence and excitement for what the future holds for us.”

Against this background why accept a private equity takeover when an IPO was being discussed after a 2022 $116 million funding raise with a $1.3 billion valuation?

Amish Mehta, Chief Investment Officer and Managing Director of Vector Capital, said, “Our investment in SingleStore underscores Vector’s commitment to investing in category-defining technology companies … As the world’s best-fit database for applications which demand ultra-low latency with transactional and analytical requirements, we believe SingleStore has the potential to become one of the most important data platforms for the AI era and are proud to support its next phase of growth alongside an exceptional group of investors and shareholders.”

Verma, staying on as CEO, said: “Building a database natively engineered for the AI era, well before the moment arrived, has been the work of more than a decade. … Now, as we look to accelerate our growth trajectory, I am delighted to partner with Amish, Stephen, and the Vector team who share our passion for innovation and our vision for what is possible to achieve when you start with an AI-ready database of unparalleled speed, scale and simplicity. I look forward to working with Vector on the next wave of innovation and further accelerate SingleStore’s growth to best serve our customers.”

We learn that Vector has bought a majority stake, speculated to be around $500 million according to Bloomberg, and that long-term SingleStore shareholders including Google Ventures, Dell Technologies Capital, IBM, and REV Venture Partners will remain as investors. Several Vector Capital limited partners will invest alongside Vector itself. A Vector MD, Stephen Goodman, said: “SingleStore represents the largest new platform investment Vector has made in over 15 years. … We are excited to partner with Raj and the SingleStore team to build on its strong momentum, expand the Company’s global reach and continue delivering the real-time, AI-ready data solutions that today’s leading enterprises require.”

Vector’s typical playbook is to buy into middle- or late-stage growth companies and bulk them up with innovative developments, expanded go-to-market, financial discipline and possible bolt-on acquisitions to build a stronger business it can sell on or make public a few years later.

How did SingleStore get to this point?

History

SingleStore was started up as MemSQL in 2011, to provide an in-memory SQL database, by Adam Prout (CTO), Eric Frenkiel (left 2017), and Nikita Shamgunov (left 2022 to be Khosla Ventures partner) in San Francisco. It created a high-performance, distributed SQL database that could handle both transactional (OLTP) and analytical (OLAP) workloads in real time, addressing the limitations of traditional databases.

MemSQL developed Helios, a public cloud version of its database in 2019, and Raj Veerma became CEO the next year. It added support for external drive-based columnar storage in 2016, increasing the amount of data it could store, and worked with Apache Kafka and Spark to support real-time data pipelines.

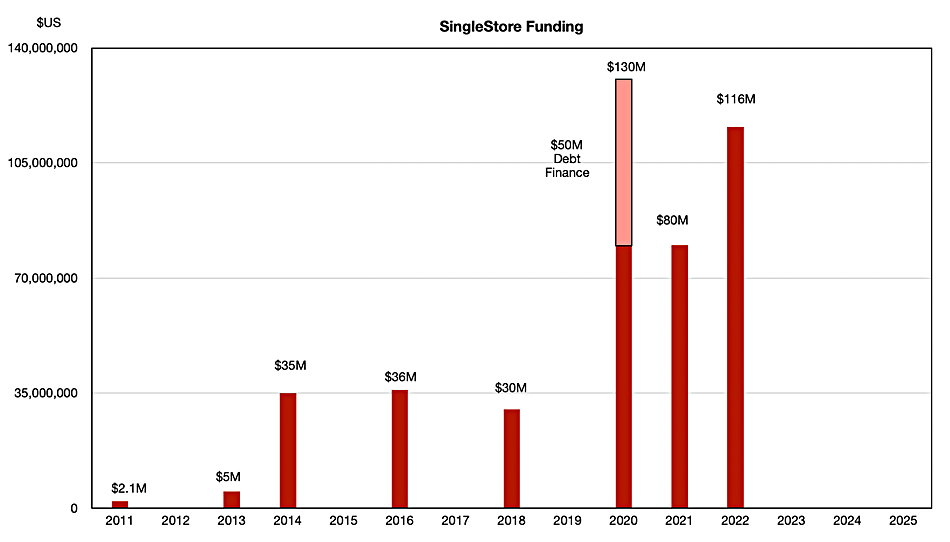

The public funding history was solid and stable up to 2020 when there was an acceleration from the previous $30 – $36 million rounds to an $80 million E-round plus $50 million in debt finance followed by a second $80 million round in 2021, with it having a $1.3 billion+ valuation, and a $116 million round in 2022. The total raised was said to be $464 million; not all raises were public. Then fund raising stopped, until now with the buyout transaction.

AI became an increasing focus from 2023 onwards with vector support added in 2024.

More and more VC focus has been placed on AI companies and AI data storage and analysis companies such as Snowflake, Dremio and Databricks. They can all be described as data platforms for the AI era.

Competitors

SingleStore’s main competitors are Snowflake, PostgreSQL, MySQL and MongoDB. It also competes with public cloud databases; Amazon Redshift, Google Cloud BigQuery, Azure SQL Database, and the Oracle Database.

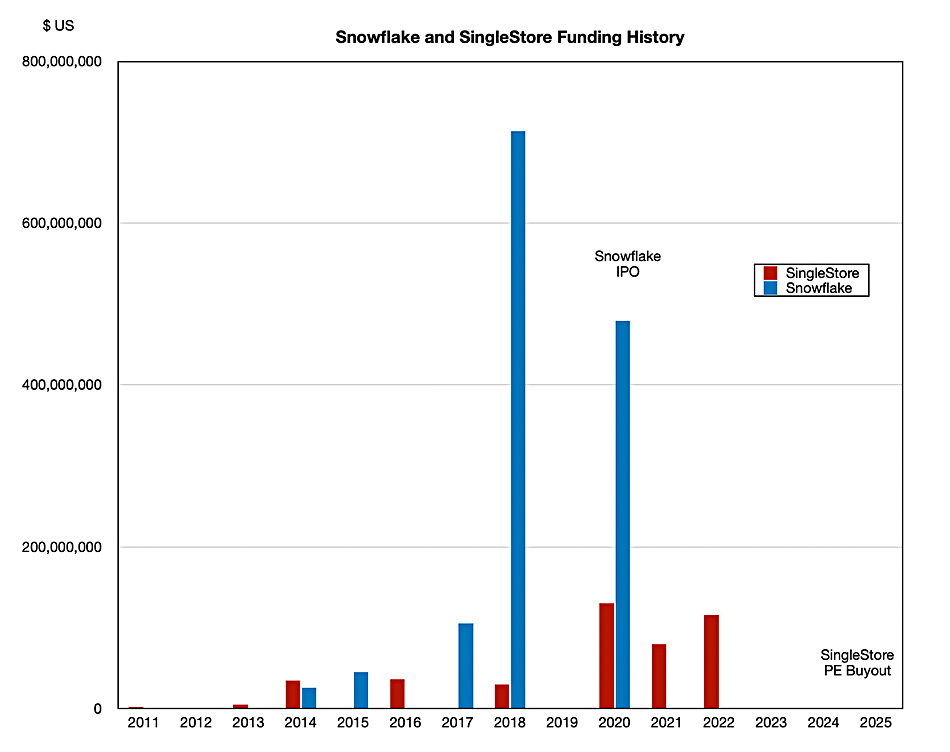

Cloud data warehouser Snowflake was started up in 2012, a year after MemSQL, and grew very quickly, with its funding rate rapidly overtaking that of Snowflake to reach a total of $1.4 billion in 2020 when its G-round raised $479 million, more than SingleStore’s total funding, and then it ran an IPO in September of that year.

As well as being out-competed by Snowflake, SingleStore had to compete with the rise of overlapping data lakes and lakehouse, notably with Databricks, which grew its funding at an enormous rate, more and faster than Snowflake, with $20 billion total funding, $10 billion of that alone raised in 2024, and a $100 billion valuation. That makes SingleStore fundraising look anaemic in comparison.

Snowflake revenues are now at the $1 billion/quarter level and growing at 30 percent Y/Y. SingleStore revenues are a fraction of that; its $123 million ARR translates to around $30 million/quarter, and it wouldn’t look that impressive as an IPO prospect. We think the VC investors’ telescope is focused more on the big AI analytics companies rather than the AI database suppliers like SingleStore.

Somehow the flurry of growth and investment in the 2020-2022 period has slowed down and SingleStore found its growth prospects limited, a near-term IPO unlikely to succeed, and a private equity buyout become more and more attractive.

It is an excellent company that needs more development as this AI era progresses. Vector and its partners will provide the cash and market expertise for that and we’ll see where this takes SingleStore in the next few years.