…

Italy-based decentralized storage amd compute supplier Cubbit has set up a regional Business Alliance Partnership with HERABIT, which is now expanding to the business market by integrating Cubbit’s DS3 Composer software into its datacenters located across Italy, in the cities of Imola (Emilia-Romagna), Siziano (Lombardy), and Santa Lucia di Piave (Veneto). The two companies are consolidating an alliance that positions HERABIT as the “preferred infrastructure partner” for Italy’s Emilia-Romagna region, paving the way for a model that can be replicated in other local and international contexts. Key use cases will range from backup to long-term data archiving, as well as the creation of data lakes for enterprises and artificial intelligence systems. HERABIT will launch the service with an initial capacity of 2 petabytes dedicated to business customers, with further expansion planned from 2026.

…

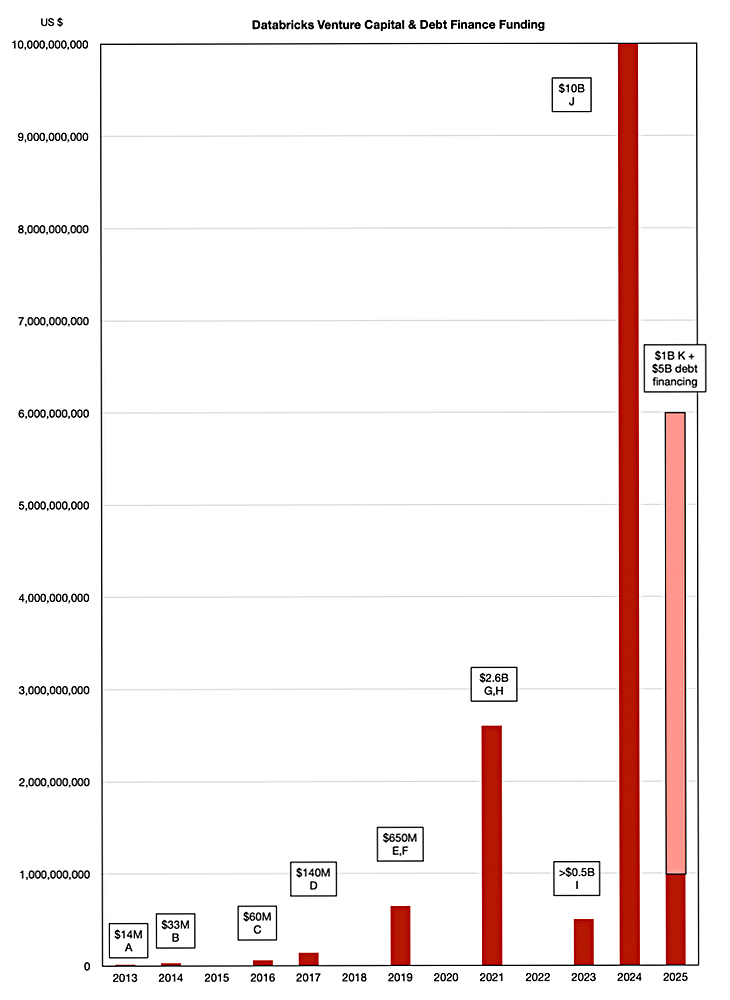

Databricks pulled in yet more funding in a $1 billion K-round at a $100 billion valuation, and with a total of $20 billion raised. It says it now has positive free cash flow. A yearly funding history chart shows its progress:

…

MinIO has unwrapped a range of AI-Stor-powered pod solutions aimed at private cloud modernization projects. The devices have the firm’s AIStor object store software pre-integrated on Supermicro x86 hardware. The fully S3 compatible range begins with a “starter” four node pod offering around 1.1PiB of usable storage. The devices are available from Arrow Electronics.

…

MSI launched the DATAMAG 40Gbps, a magnetic portable SSD. Available in 1TB, 2TB, and 4TB capacities, the DATAMAG leverages the USB4 40Gbps interface to deliver transfer rates of up to 4000 MB/s read and 3600 MB/s write, making it one of the fastest portable SSDs in its class. Complementing the hardware, the dedicated DATAMAG App provides users with an intuitive way to check remaining capacity, back up and restore photos and videos, and keep important data safe and accessible at all times. It features a unique magnetic attachment system. Using the included metal rings, the drive can snap securely to laptops, tablets, or phones, ensuring stable connections and easy access. A hanging ring adds further convenience, keeping the SSD within reach wherever work takes you.

…

Nvidia’s surging AI business is pulling a raft of other component sectors along in its wake, latest research from Dell’Oro Group shows. The on-going AI expansion cycle, driven by Nvidia’s Blackwell Ultra, as well as custom accelerators from Google and Amazon helped fuel 44 percent year on year growth in the server and storage component market. It boosted demand across HBM memory, backend NICs, and Grance ARM CPUs, the firm said, with ARM CPUs accounting for a quarter of the server market. It added that custom accelerators were not shipping in “volumes comparable to commercial GPUs”. For the year as a whole, growth should hit 46 percent.

…

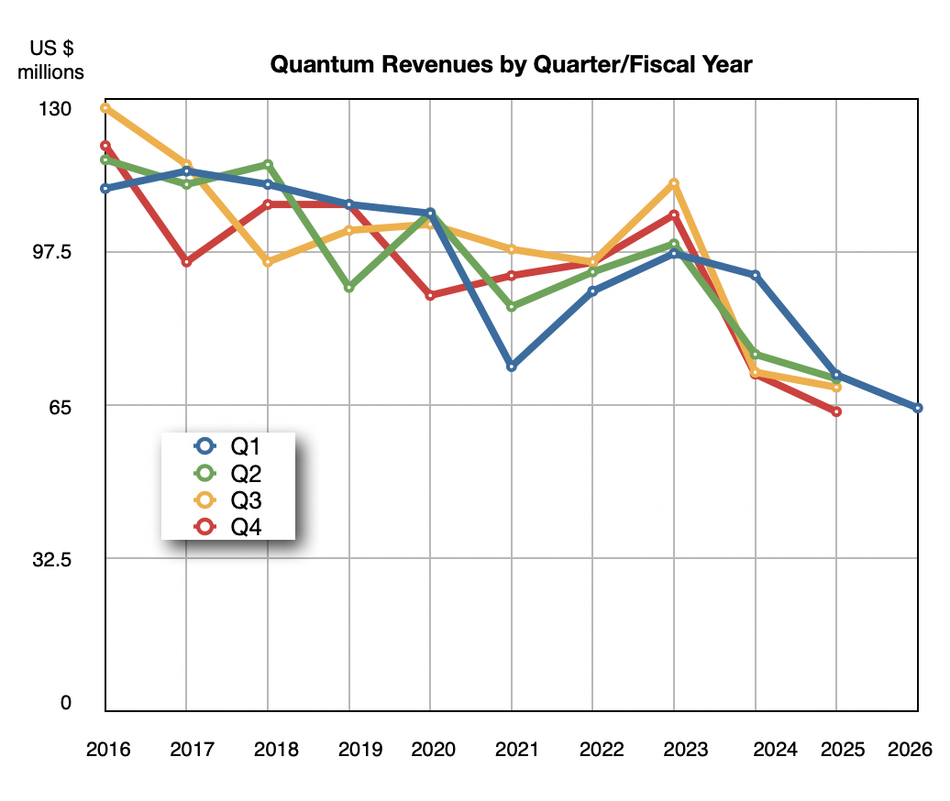

Quantum announced its Q1 fy2026 revenues went down 9.9 percent Y/Y to $64.3 million with a loss of $17.2 million compared to the year-ago $19.9 million loss. New CEO Hugues Meyrath, determined to reverse Quantum’s dismal downwards trend, said: “Leveraging extensive industry experience and my familiarity of the Company as a board member, the Company has implemented immediate and ongoing actions aimed at further improving the cost structure and balance sheet. Additionally, we have recently strengthened our executive team with key new hires in sales and marketing to execute on our revitalized go-to-market strategy, as well as expanded the Board with two newly appointed directors that each bring highly relevant industry experience.”

The next quarter outlook is for revenues of $62 million, down 12 percent Y/Y. It also filed its delayed Q4 and full fiscal 2025 year accounts with the SEC.

…

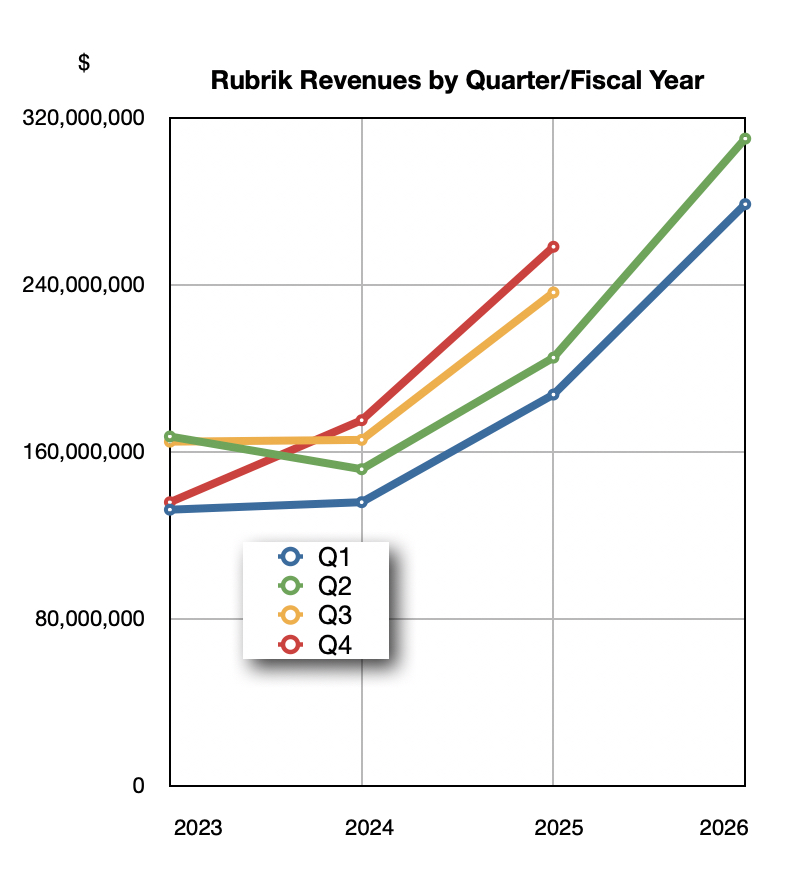

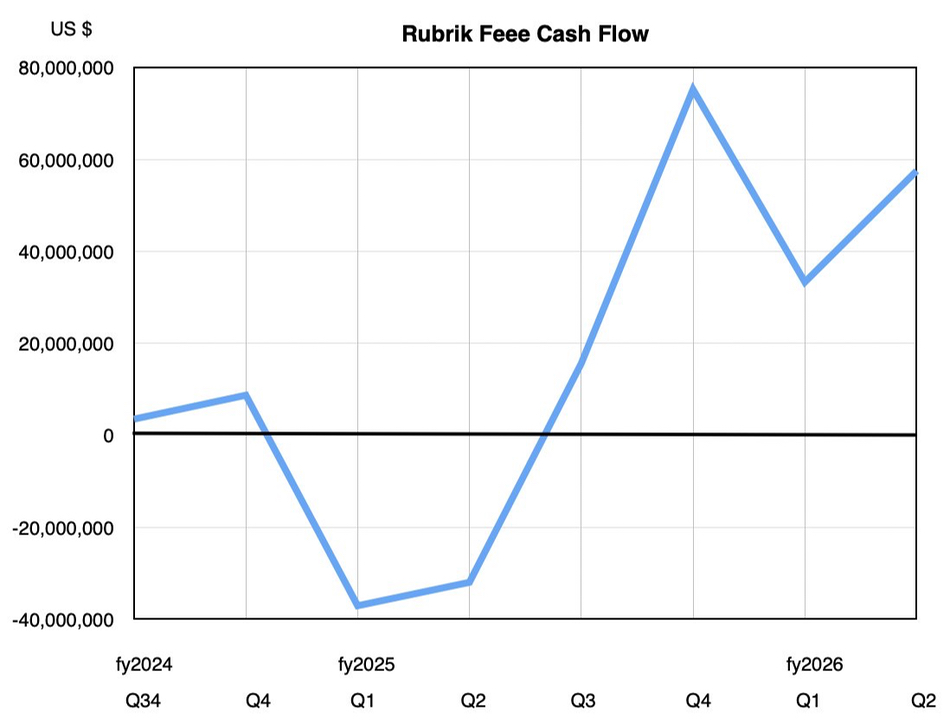

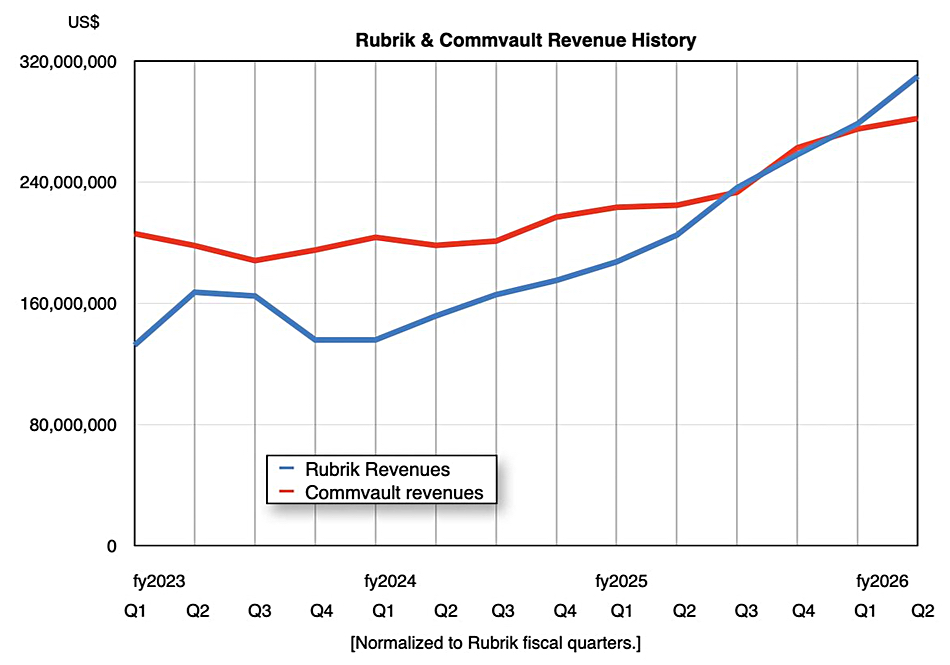

Rubrik revenues shot up 51 percent in its second fiscal 2026 quarter to $309.9 million with a loss of $95.9 million, better than the year-ago $176.9 million loss. Subscription revenue was up 55 percent to $97 million and it has 2,505 customers with more than $100,000 in subscription ARR; up 27 percent. Here are charts showing (1) it accelerating revenue growth by quarter by fiscal year (2) its improving free cash flow trend over recent quarters, and (3) its revenues compared to those of now overtaken competitor Commvault:

…

…

SK hynix announced this week that it had completed development of HBM4 and was now ready to move to mass production with the high bandwidth memory implementation. The components will help “overcome the technological challenges of the AI era” the Korean company said. The latest iteration sees a doubling of bandwidth, thanks to 2048 I/O terminals, with 10Gbps operating speed. Power efficiency has been improved by 40 percent. SK hynix claimed this will improve “AI service performance by 69 percent.”

Meanwhile, SK Hynix has begun shipping its ZUFS 4.1 mobile NAND solution to customers, potentially boosting the potential for onboard AI on mobile devices. The product is optimized for on-device AI and large-scale data processing, and should help reduce app launch time by 45 percent, the firm said. ZUFS is an extended spec of UFS. The Z refers to the use of Zone Storage technology, storing data in different zones depending on its usage and characteristics.

…

Solidigm’s Roger Corell, senior director of AI and leadership marketing, said in a TechRadar interview: “We’re actively exploring next-gen capacities, form factors, and system-level innovations that will redefine how storage is deployed at scale. This includes our plans to ship 245+TB drives by the end of 2026.” Solidigm currently ships D5-P5336 122 TB SSDs built with 192-layer 3D NAND. They are in QLC format and supplied in a U.2 enclosure. Parent SK hynix has announced 321-layer NAND. The new E2 EDSFF standard format could provide the physical space for Solidigm increasing the P5336’s capacity up to the 345+ TB area without having to upgrade to higher layer count technology.

…

TrendForce reveals that the massive data volumes generated by AI are straining the global infrastructure of data center storage. Nearline HDDs, traditionally the backbone of large-scale data storage, are now facing severe supply shortages, pushing high-performance yet higher-cost SSDs into the market spotlight. In particular, shipments of high-capacity QLC SSDs could see explosive growth in 2026. It notes that, because major HDD manufacturers have not expanded production capacity in recent years, they are unable to keep up with the sudden, massive surge in storage demand driven by AI. As a result, lead times for nearline HDDs have ballooned from just a few weeks to over 52 weeks, further widening storage gaps for CSPs. North American CSPs had already been planning to increase SSD adoption for warm data workloads. However, the severity of the current HDD shortfall has prompted some providers to consider deploying SSDs for cold data. Enterprise SSD contract prices are projected to rise 5–10% QoQ in 4Q25.

…

ZDNet Korea reported that YMTC is interested in entering the HBM market potentially through a collaboration with CXMT, which would supply DRAM.

…